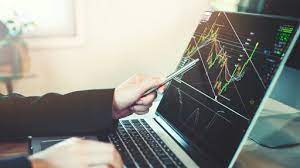

Automated trading explained – everything you need to know about trading bots

Automated trading has become increasingly popular among traders of all kinds of financial assets such as crypto, commodities stocks, futures, etc. Thanks to their features, traders worldwide manage to make decent profits on the side by trading while staying committed to their regular jobs. It doesn’t matter if you are a newbie or a professional. Trading bots are suitable for all trading experience levels. If this sounds interesting to you, keep reading the following lines and see what it’s all about.

What is automated trading?

A trading robot is an automated trading system that will generate buy or sell orders without any human intervention, according to a program carried out by a computer developer, depending on market conditions. We, therefore, also speak of systematic trading, as opposed to discretionary trading in a fund where orders are decided and executed by a trader.

People often confuse algorithmic trading with trading systems. Most of the volume processed in algorithmic trading comprises algorithmic orders, not orders from trading systems.

An algorithmic order is an order that reproduces the know-how of traders but in an optimized way via an algorithm. Suppose a fund manager gives a limit buy order of 1 billion EUR/USD to a bank.

The concern of the manager, aware that his order is large, is not to be massacred on the execution price. Therefore, the bank trader will ask the client for a certain delay to sell the order while limiting the impact on the market.

In practice in the past, the trader dealt by voice with other banks and with around ten counterparties. In addition, the orders had to have a minimum amount, at least a few million euros. Otherwise, the counterparties were not interested.

Now, with an algorithm, the order of 1 billion is “cut” into several hundred orders which are rerouted on several dozen platforms.

In addition, the algorithm is intelligent, constantly scans the overall depth of the market, and only presents a part of the order that can be absorbed easily. Thus, at times, a mid-market execution price (between the bid and the ask) can be obtained.

It results in an average execution price better than what the best trader on earth could have done by trading at discretion…

How to find the reliable auto-trading software

First, you will need to determine your trading style and the types of assets and markets you want to trade. Then, you can open an account with a chosen platform accordingly, set trading parameters, and place your first market orders. But before opening an account and founding it with an initial deposit, research as many offers as possible. Read reviews such as Biticodes review once you find the platform that draws your attention. Then, take time to compare several offers and try out a demo account on each of them to check their features and find the one that suits you the best. Always remember that the good choice of a trading software is the first step toward your trading success.